|

| photo source |

I have two kids now. Both are boys, a 12-year old and a 2-year old. Because of this, many people are encouraging us to have another baby again and maybe it will be a girl. Maybe... But we always leave everything to God. If He will give us another baby, a baby girl, then we will be grateful. That's another story I would like to write about.

Speaking of kids, we can teach them how to save as early as possible. Saving is something my parents don't teach me when I was a kid. Fortunately, I learned it my self or maybe I just value the hard earned money my parents gave me.

Here's how to teach kids save money:

Start them young

Start them young simply means "to begin doing something when you are young." Most parents may relate to this phrase especially when teaching their kids doing house chores, healthy eating habits, good manners and the likes. Teaching kids to save money while they are young is a good start.

Teach them the value of money

Teaching our kids the value of money will teach them how to save money but also how to spend money wisely. As a kid, I see how my mother worked until wee hours to be able to send us to school and buy our basic needs. That maybe the reason why I learned to save and spend wisely.

Now as a parent, I am telling my kids that we can not just buy what they want. It also helps that they go with us when we do the groceries and show them how to buy wisely. My eldest will sometimes exclaim "Mom, this is so expensive," and people will like us and say "he already know what's expensive is."

Open a bank account and have a savings goals

There are banks that offers kids to open their own account. Here, you will be able to save their own money. Just in time with Christmas season, many kids received money from their Ninongs and Ninangs. Instead of spending, this can be placed in their bank account. Kids will also able to see how much money they have and monitor it through their passbook. You can set a savings goals for them too.

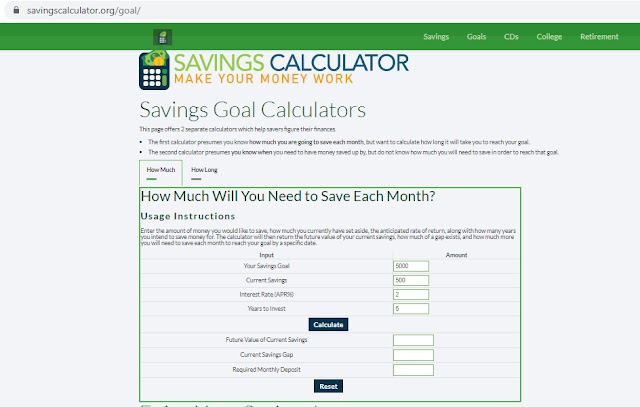

You can use SavingsCalculator.org to calculate savings goals.

You can use this calculator to know how much you are going to save each month and also to calculate how long it will take you to reach your goal.

Learn the Needs and Wants

Kids, in nature, are considered impulsive buyers. They have the tendency ask something to buy when you are in the mall or grocery. By teaching them to know what are the things they need or wants can help them think and reduce their urge to buy something at an instant.

Teach them how to earn money

Giving reward system will help kids learn how to earn their own money. Giving them simple house chores like cleaning their room, washing the dishes, vacuuming dirt in the carpet, taking care of their siblings will be a great way for them to have extra amount by handling them money on your payday.

Those are ways how to teach kids to save money. Start them young is a good start. Saving will be a habit for them in the load run. And most of all, be a good example. Show them you also do what you are teaching them.

That's it. I hope I get to help you and your kids. It will be also nice if you can share your experience as well.